Our drug screening approach helps companies get their products to market with lower cost and less uncertainty.

About Us

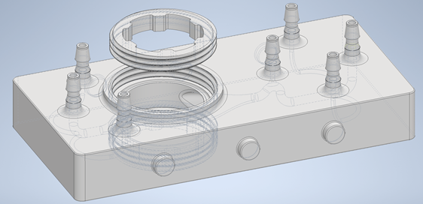

Welcome to CellField Technologies, where innovation meets precision in the realm of preclinical testing for joint diseases. Our pioneering Microphysiological Articular Joint In a Chip (MAJIC) system is at the forefront of cutting-edge technology, offering a revolutionary modular cell culture platform. At the heart of our mission is the commitment to transform the landscape of drug development, starting with diseases like osteoarthritis (OA) and rheumatoid arthritis (RA).

Biotech News

I recently wrapped up my internship at CellField Technologies, where I had the chance to dive right into the research and development of their flagship product, a microphysiological joint-on-a-chip. Over the summer, I developed a new chip model that optimized fluid distribution and dynamics, engineered a mechanism to precisely apply grease, created a system to ensure a strong seal between the chip and its lid, and designed a luer-lock that ensures a tight fit with a syringe. I also worked on plans for automation features that could bring the system even closer to true in vitro use. Beyond the design work, I spent a week training in the IVAC lab in Biddeford under Dr. Ling Cao, where I learned cell culturing techniques and gained experience with specialized equipment. I was able to spend significant time around cell culture and learn directly from other researchers in the lab, an experience that gave me valuable insight into the world of cell culture. The internship offered a unique opportunity to wear many hats at an innovative biotech startup. I’m excited to follow CellField Technologies as they continue advancing the MAJIC (micro physiological joint on a chip) and I am deeply grateful to CellField for making this summer such an impactful experience. Written by Heath Fellows, CellField Technologies Summer 2025 Research Scientist Intern

Intern Spotlight: Heath Fellows Heath is from Lake Tahoe, California, and currently studies at Bates College, where he’s majoring in Biochemistry with a minor in Computer Science. His passion for biotechnology stems from a deep fascination with how the field merges science and innovation. Originally entering college thinking he would pursue medicine, Heath quickly found himself drawn to biotech after taking several organic chemistry courses. His interest in computer science, which began in high school, led him to envision a future where he could combine both fields ideally in biostatistics or another area that merges computation with biology. Heath’s introduction to research began early, during high school. For his senior thesis, he designed an original project focused on post COVID facial recognition, specifically how masks affected recognition accuracy. He built and coded facial recognition trials himself and conducted the study using middle school students as participants. The experience taught him how to frame research questions and build a project from the ground up, and it sparked his love for building things whether in code, design, or science. When asked why he wanted to intern at CellField Technologies, Heath said the company’s mission really stood out to him. He saw firsthand how joint diseases like osteoarthritis impact people close to him, and the opportunity to work on research aimed at prevention and better diagnostics felt meaningful. He also appreciated CellField’s ethical commitment to reducing animal testing, something he strongly supports. After researching the company, Heath was particularly fascinated by the MAJIC system and knew he wanted to contribute to the team’s work. Since day one, Heath has been hands on. He began his internship designing a 3D model of one of the company’s chips, starting from blueprint history files. While it may seem straightforward, the modeling required extreme precision and every angle and measurement needed to be just right. He’s spent time learning the 3D printer workflow and mastering new software to help modify components of the chips. Looking ahead, his work will expand into cell culture, where he’ll help grow donor derived joint cells on the chip. Heath has already learned a tremendous amount in his time with CellField from advanced lab tools and techniques to foundational knowledge about osteoarthritis and the materials used in tissue engineering. He attends monthly meetings with Poly Med, where he’s exposed to cutting edge biomaterials and ideas. He speaks highly of Dr. Wood, praising his ability to explain complex topics clearly and concisely. Looking to the future, Heath sees this internship as a powerful stepping stone. Heath says the skills he’s learning from 3D modeling to cell culture and electrospinning will serve him well as he moves forward in biotech. He's also excited about the connections he's making in New England and enjoys working in Portland. Outside of the lab, Heath is an avid cyclist. He bikes to work every day logging a total of 58 miles daily and races competitively as part of a Portland based team. He also enjoys painting, art, and spending time with friends in the city. In three words, Heath describes his experience at CellField Technologies as: innovative, challenging, and eye opening. And his dream vacation? Anywhere in Italy, especially Lake Como. He loves the food, fashion, and culture, and hopes to explore the countryside and visit Italy’s iconic cities one day.

I ntern Spotlight: Tommy McGuire Tommy McGuire is a senior at the University of New England studying Business Administration. Originally from New Jersey, Tommy brings a strong interest in how businesses operate and grow. This is something he developed early on with one of his first jobs selling PPE products. He joined CellField Technologies in January after finding the opportunity on Handshake. At the time, he wasn’t familiar with biotech or joint-on-a-chip platforms, but was interested in stepping into something new. Since then, he’s been drawn in by the mission and the impact CellField is working to help in drug research for treatment of joint disease. At CellField, Tommy creates articles for the company’s LinkedIn and website, helps manage the content schedule, and is soon to take on accounting responsibilities. He also led the team’s pitch for the Top Gun competition in May, gaining valuable experience in business strategy and presentation. He says the internship has helped him grow professionally, build strong connections, and gain a better understanding of the kind of work he wants to pursue after graduation. Outside of work, Tommy enjoys fishing, golfing, working on cars, and spending time with friends and family. He’s always looking for adventure, especially near the beach. His dream trip is to Italy, especially San Donato where his mothers family is from. This is a place he hopes to visit to connect with his roots and experience the culture. When asked to sum up his time at CellField so far, Tommy says it’s been a valuable experience full of learning, growth, and new opportunities.