Monetizing Biotech Innovation: Licensing vs. CRO Business Models

The Business of Biotech: Turning Research into Revenue

Biotechnology startups often face a pivotal decision when bringing their innovations to market: should they license their intellectual property (IP) to larger firms, or operate as a contract research organization (CRO) to generate revenue through specialized preclinical testing services? Each business model offers distinct advantages and challenges, and the optimal choice depends on factors such as scalability, funding requirements, and long-term strategic objectives.

The Licensing Model: High Stakes, High Rewards

In the licensing model, a biotech startup develops a proprietary innovation—such as a novel drug, technology, or process—and licenses its patents to a larger pharmaceutical or biotech company. In exchange, the startup receives upfront payments, milestone fees as development progresses, and royalties on future sales if the product reaches the market.

Advantages of Licensing:

Lower Operational Burden: Licensing eliminates the need to build extensive infrastructure, such as laboratories or large research teams. This allows startups to maintain a lean operation focused on innovation rather than execution.

Scalability Potential: A single licensing deal with a major firm can generate significant revenue without requiring ongoing effort, provided the partner successfully commercializes the technology.

Attractive Exit Opportunities: Licensing agreements with prominent companies often enhance a startup’s valuation, positioning it as a prime candidate for acquisition or further investment.

Challenges of Licensing:

Reduced Control: Once the IP is licensed, the larger company assumes responsibility for development and commercialization, potentially making decisions that diverge from the startup’s original vision.

Uncertain Revenue: Payments are contingent on the partner’s success in navigating clinical trials, regulatory approvals, and market launches—a process that can take years and may not always succeed.

Complex Negotiations: Securing favorable licensing terms requires robust IP protections, legal expertise, and the ability to demonstrate market leverage, which can be challenging for early-stage startups.

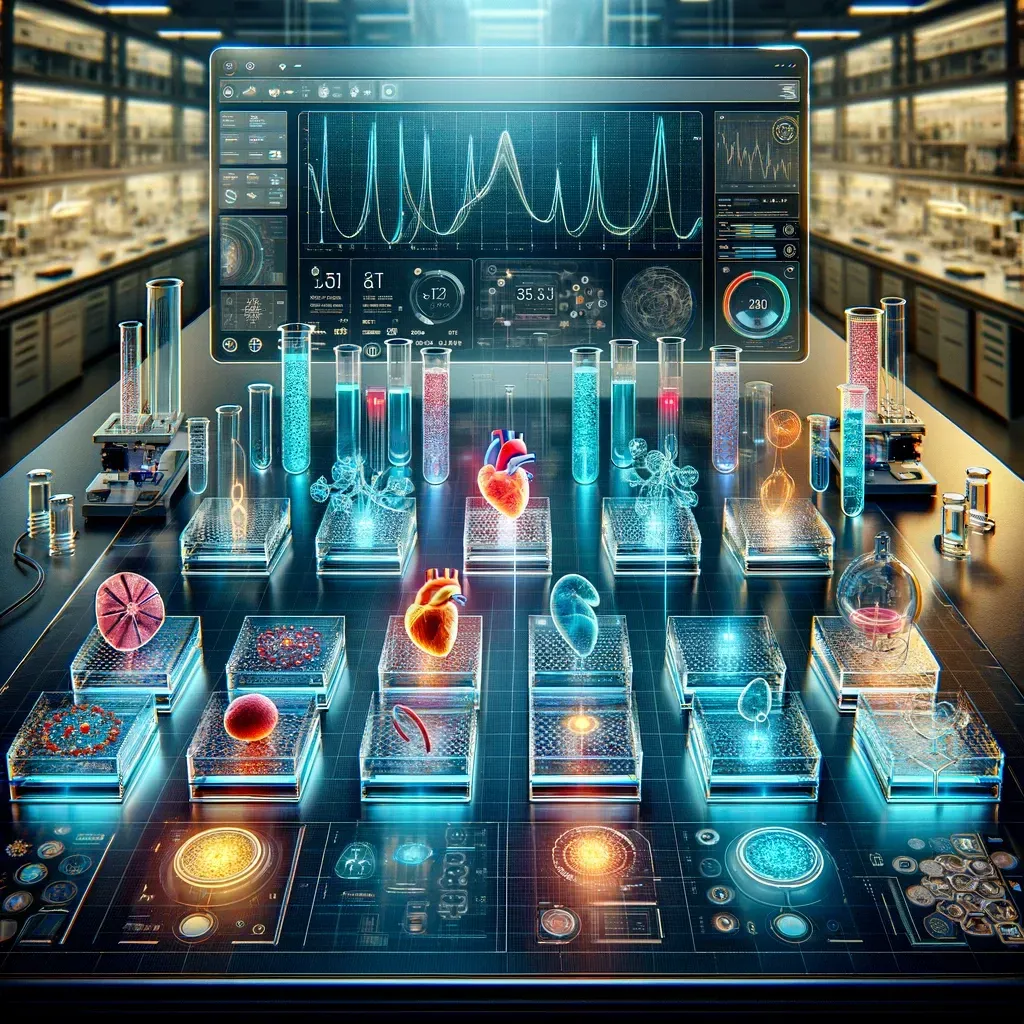

The CRO Model: Steady Income, Operational Intensity

In contrast, the contract research organization (CRO) model involves a biotech startup providing specialized preclinical testing and research services to other companies, often small-to-mid-sized pharmaceutical firms. Rather than waiting for long-term royalty payments, CROs generate revenue on a project-by-project basis, offering services such as drug screening, toxicology studies, or biomarker analysis.

Advantages of the CRO Model:

Consistent Revenue Streams: By securing contracts for individual projects, CROs establish a predictable cash flow, which can help sustain operations and fund further innovation.

Higher Profit Margins: Unlike licensing, where revenue depends on external success, CROs charge directly for their services, retaining a larger share of the profits.

Market Credibility: Successfully delivering services to multiple clients can enhance a startup’s reputation, providing valuable validation of its expertise and technology, which in turn can attract investors or partners.

Challenges of the CRO Model:

Operational Complexity: Running a CRO requires significant infrastructure, including laboratory facilities, skilled personnel, and compliance with stringent regulatory standards.

Growth Constraints: While licensing offers the potential for exponential returns from a single deal, CROs must continuously secure new contracts to maintain growth, which can limit scalability.

High Initial Investment: Establishing a functional lab and hiring qualified experts often demands substantial upfront capital, posing a barrier for resource-constrained startups.

Key Considerations for Choosing a Model

The decision between licensing and operating as a CRO hinges on several critical factors, each of which must be carefully evaluated in the context of a startup’s unique circumstances.

Nature of the Innovation: Startups with groundbreaking, highly protectable IP—such as a novel therapeutic platform—may find licensing more appealing, as it allows them to capitalize on their innovation without the burden of operational scaling.

Revenue Needs: For startups requiring immediate cash flow to sustain operations, the CRO model offers a faster path to revenue, whereas licensing may be better suited for those with the resources to wait for long-term returns.

Risk Tolerance: Licensing involves greater uncertainty, as revenue depends on the success of the partner’s development efforts. In contrast, the CRO model provides more predictable income but requires ongoing operational effort and investment.

Exploring a Hybrid Approach

Some biotech startups opt for a hybrid strategy, combining elements of both models to balance short-term stability with long-term growth potential. For instance, a startup might initially operate as a CRO to generate revenue and build industry credibility, while simultaneously seeking licensing opportunities for its proprietary technologies. This approach can provide a financial cushion during the early stages, enabling the company to fund its own R&D and pursue high-value licensing deals over time. Additionally, the expertise gained through CRO services can strengthen the startup’s position in licensing negotiations, demonstrating its technical capabilities to potential partners.

Strategic Alignment Is Key

Ultimately, there is no universally superior model—success depends on aligning the chosen strategy with the startup’s financial goals, operational capacity, and long-term vision. The licensing model offers a pathway to potentially massive returns with minimal ongoing effort, making it ideal for startups with disruptive innovations and a tolerance for delayed gratification. Conversely, the CRO model provides stability and control, appealing to those prioritizing steady growth and direct market engagement. A hybrid approach, meanwhile, can offer the best of both worlds, though it requires careful management to avoid overstretching resources.

In the fast-evolving biotech landscape, adaptability is essential. By thoroughly assessing their strengths, market position, and strategic objectives, biotech startups can select a business model—or combination of models—that positions them for sustainable growth and impact.

Biotech News